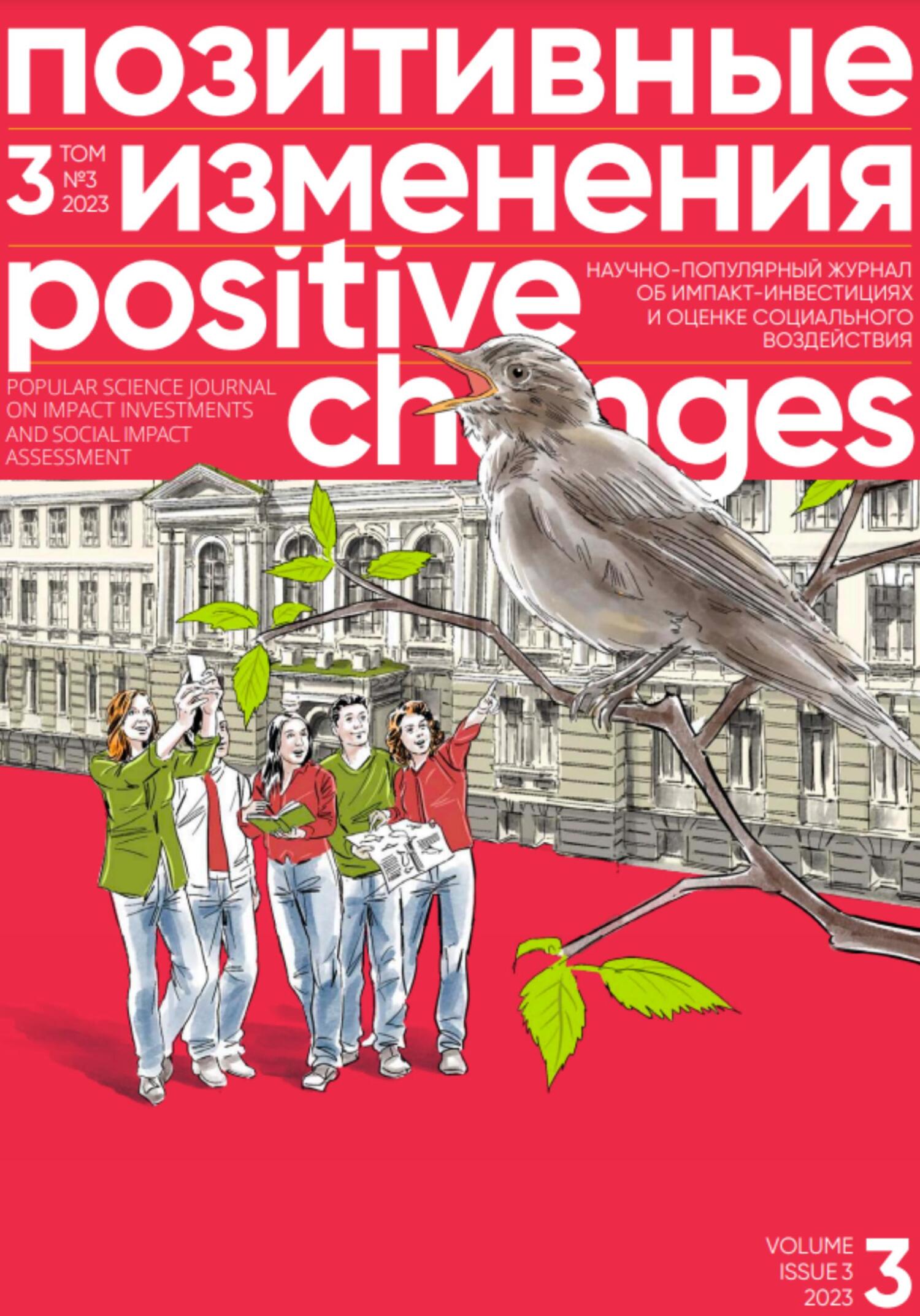

Книга Позитивные изменения. Том 3, № 4 (2023). Positive changes. Volume 3, Issue 4(2023) - Редакция журнала «Позитивные изменения»

На нашем литературном портале можно бесплатно читать книгу Позитивные изменения. Том 3, № 4 (2023). Positive changes. Volume 3, Issue 4(2023) - Редакция журнала «Позитивные изменения» полная версия. Жанр: Книги / Разная литература. Онлайн библиотека дает возможность прочитать весь текст произведения на мобильном телефоне или десктопе даже без регистрации и СМС подтверждения на нашем сайте онлайн книг knizki.com.

Шрифт:

-

+

Интервал:

-

+

Закладка:

Сделать

Перейти на страницу:

Перейти на страницу:

Внимание!

Сайт сохраняет куки вашего браузера. Вы сможете в любой момент сделать закладку и продолжить прочтение книги «Позитивные изменения. Том 3, № 4 (2023). Positive changes. Volume 3, Issue 4(2023) - Редакция журнала «Позитивные изменения»», после закрытия браузера.

Книги схожие с книгой «Позитивные изменения. Том 3, № 4 (2023). Positive changes. Volume 3, Issue 4(2023) - Редакция журнала «Позитивные изменения»» от автора - Редакция журнала «Позитивные изменения»:

Комментарии и отзывы (0) к книге "Позитивные изменения. Том 3, № 4 (2023). Positive changes. Volume 3, Issue 4(2023) - Редакция журнала «Позитивные изменения»"